Q1 2025 Investment Review

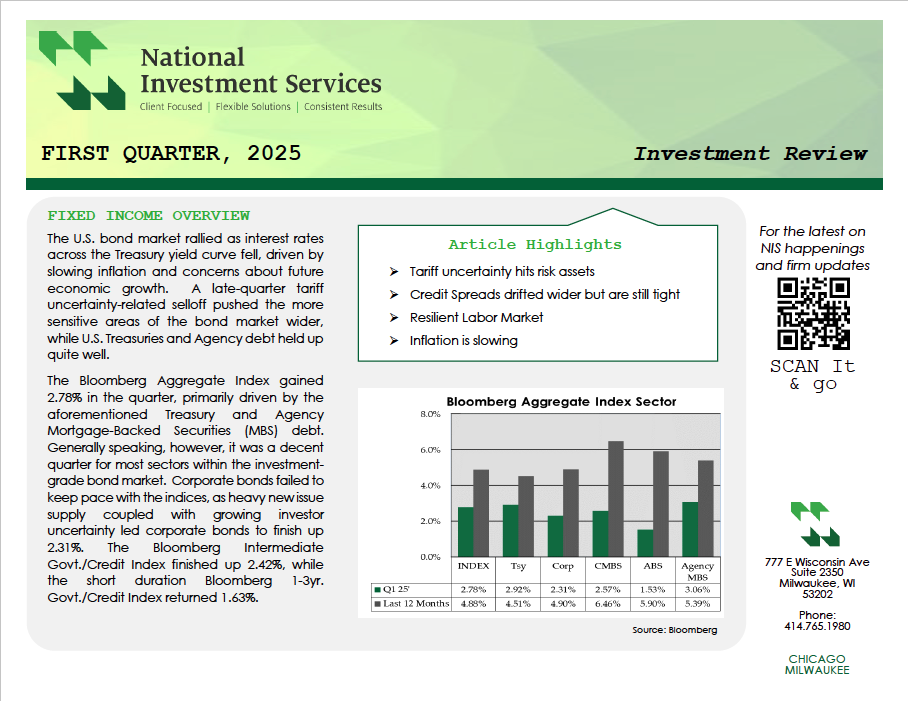

In Q1 2025, U.S. bond markets rallied as inflation slowed and economic growth concerns increased, leading to lower Treasury yields and strong returns for government-backed bonds. However, riskier bonds saw volatility, and corporate bonds lagged due to heavy issuance and investor caution.

The U.S. economy remained steady but showed signs of slowing, with solid job growth but weaker consumer sentiment and persistent inflation above the Federal Reserve’s target. The Fed kept rates unchanged, signaling a cautious, data-driven approach.

Looking ahead, uncertainty over trade and tariffs is expected to influence markets. The report recommends a cautious investment stance, favoring high-quality bonds and stable sectors, while remaining selective and managing risk carefully amid ongoing economic and policy changes.